March 1, 2022 by Clarissa Ayala

LSLA Reduced Property Taxes, and Obtained Medical Coverage and SNAP for 92 Year Old Veteran of WWII and the Korean War

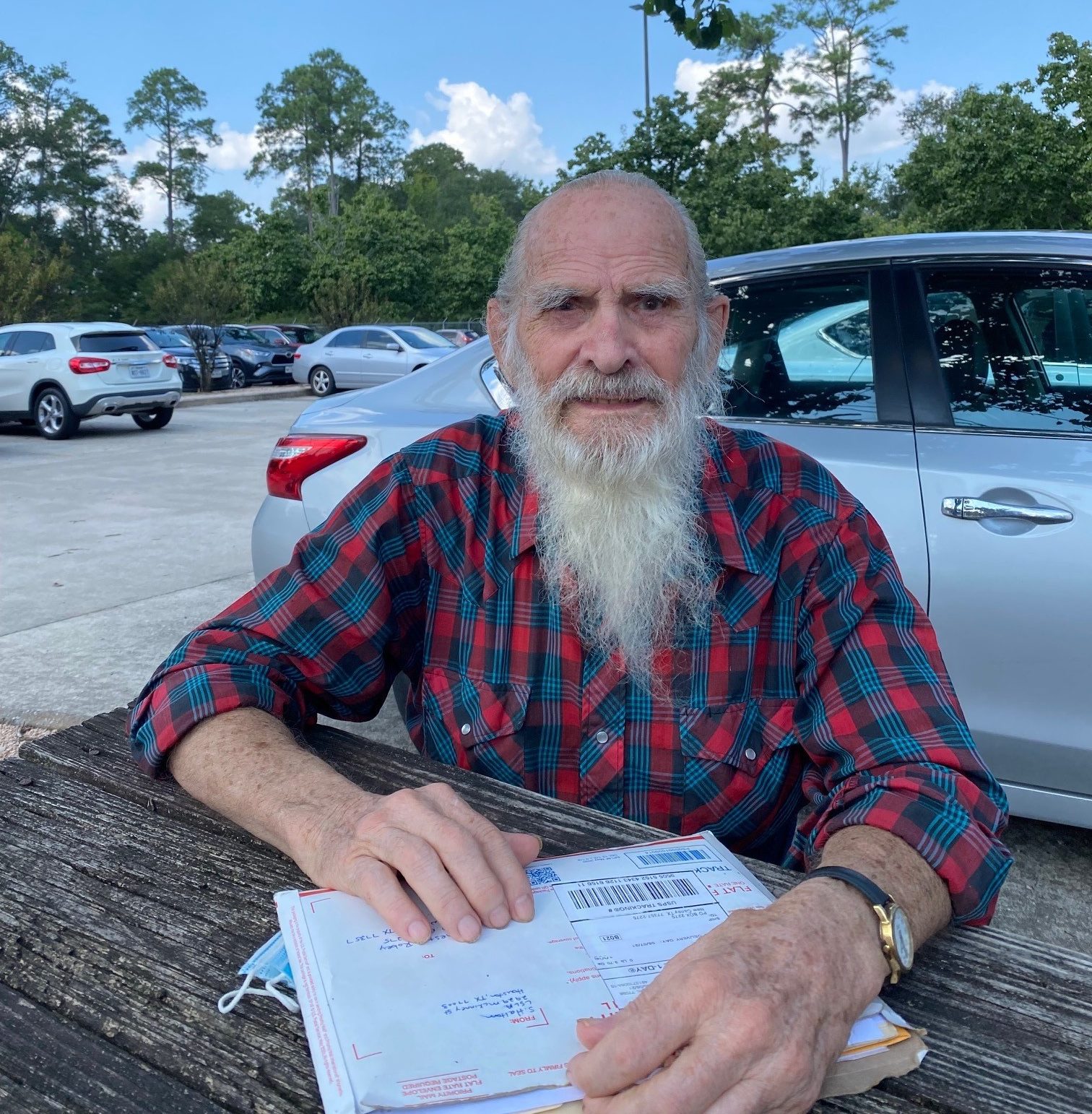

Chester Robey is a 92 year old veteran of both WWII and the Korean War. He is mostly blind, mostly deaf, and has Parkinson’s, which makes it difficult for him to walk and write. His only income is Social Security, and he relies on the assistance of a neighbor to help him get around.

Mr. Robey contacted our Military and Veterans Unit earlier this year regarding his property taxes in Montgomery County. He purchased a parcel of land in 1978, and then later that year purchased a second adjoining parcel. His trailer sits on one of the lots, and he has a storage shed on the other.

In the early 1980s, he went to the Montgomery County Tax Office and asked to have a homestead exemption applied to both lots. He was told he could only have the exemption applied to the lot where the trailer sits. Mr. Robey accepted this decision, and since he has been paying the full tax rate on the second lot, while receiving a homestead exemption on the other.

Attorney Sondra Haltom reviewed the property records and determined that Mr. Robey should have been eligible to claim a homestead exemption on both lots, since they are contiguous, less than 10 acres, and Mr. Robey uses the lots as one combined property as his homestead.

Additionally, the appraised value of both properties was higher than it should be. Mr. Robey’s appraisal value had nearly doubled between 2019 and 2021, despite the property being damaged significantly due to flooding, including causing parts of Mr. Robey’s floor to cave in. Mr. Robey cannot afford flood insurance, and FEMA did not provide nearly enough funds to repair all the damage.

Attorney Haltom helped Mr. Robey file a protest on the value of both lots. She subsequently filed a request to combine the lots and apply the homestead exemption to both.

As of September 21, 2021, the Montgomery County Appraisal District had combined the properties, reduced the appraised value by $70,000, and retroactively applied the homestead exemption back to 2019, resulting in a refund owed to Mr. Robey on his property taxes.

While the property case was pending, Attorney Haltom also helped Mr. Robey apply for food stamps and Medicaid, as well as drafting his will. Currently, Attorney Haltom is assisting Mr. Robey with a claim for VA Pension benefits earned through his honorable service in the Navy.